Follow Us

10 Street Name, City Name

Country, Zip Code

555-555-5555

myemail@mailservice.com

What is an Effective Rate

DigitalPayments

The effective rate is the total percentage you pay per transaction for credit card processing, taking into account all the fees involved.

Instead of just looking at individual fees, it's important to consider this overall percentage to understand the true cost of credit card processing.

For a regular, low-risk business, your effective rate should be about 3-4% — and no higher.

High-risk merchants, unfortunately, can expect to pay much more in rates and fees — often nearly two times more than a comparable low-risk business.

If you’re already accepting credit cards, you can quickly determine your actual effective rate by analyzing your most recent credit card processing statements. (Total monthly fees / Total monthly sales) x 100 = Effective Rate

Effective Rate: 0%

INTERCHANGE FEES + ASSESSMENT FEE + BASIS POINTS = TRANSACTIONS

You’ve probably heard of another type of fee–the interchange fee–before coming across this article. Aren’t assessment fees and interchange fees the same thing? Many merchants are surprised to learn that interchange fees and card brand fees are two completely separate things.

The reason for this confusion is that both types of fees are considered part of the “wholesale” cost of card processing, as opposed to the “markup.” This means that assessment fees (and interchange fees) are both a part of your processor’s cost of doing business…which it has conveniently passed down for you to pay. The only difference between interchange fees and assessment fees is that interchange fees are paid to the card’s issuing bank, while the assessment fees are paid to the credit card associations

Net Amount After Fees: $0.00

Difference (Sale Price - Net Amount): $0.00

Dollar Value of Basis Points: $0.00

How It Works: calculator that can calculate and display the net amount after fees, the difference between the sale price and the net amount, and the dollar value of the Basis Points of the Sale Price. Users can input the required values, and upon clicking the "Calculate" button, they will see all the calculated amounts.

- Sale Price of product or Service: Enter a Dollar Value

- Interchange, Assessment Fee, and Basis Points Inputs: These fields allow the user to enter the respective percentages and decimal values.

- Cost Per Transaction Input: This is where the user enters the base cost of the product or service.

- Calculation Button: When clicked, the script calculates the total percentage by adding the Interchange, Assessment Fee, and Basis Points (converted to a percentage). It then applies this total percentage to the Cost Per Transaction to calculate the Total Cost.

- Total Cost Display: The result is displayed under the 'Total Cost' label.

- Net Amount: Deposit to Merchant after fees deducted

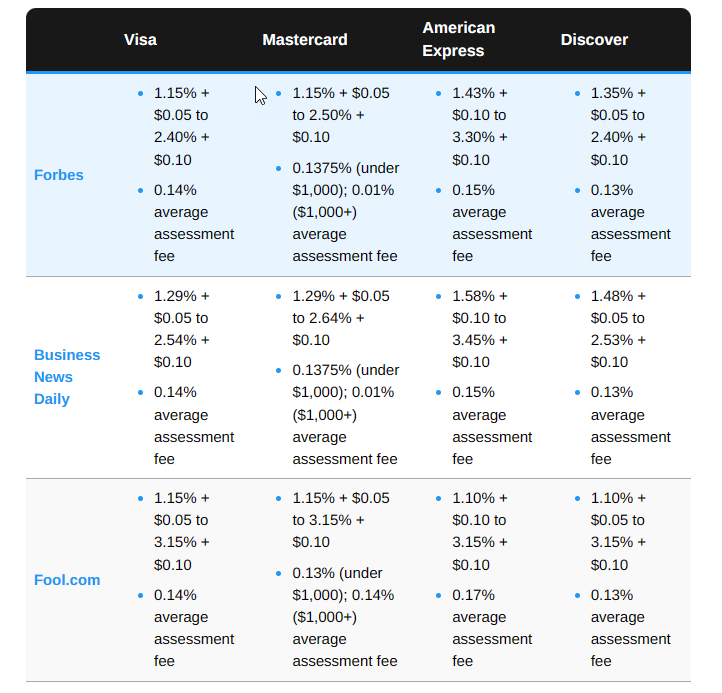

- Interchange Fees: Wholesale Cost of Accepting Credit Card ( Interchange will vary by Card type )

- Profit made by a Processor for facilitating the transaction

Ready to get started

This is a lead generation Landing page